8 Passive Income Opportunities That Really Work

Earning passive income can be an effective way to expand your earnings and achieve financial security, but it requires work up front as well as ongoing management.

There are numerous methods of creating passive income streams, from starting a blog or YouTube channel to building Alexa skills. Here are 10 Passive Income Opportunities That Really Work!

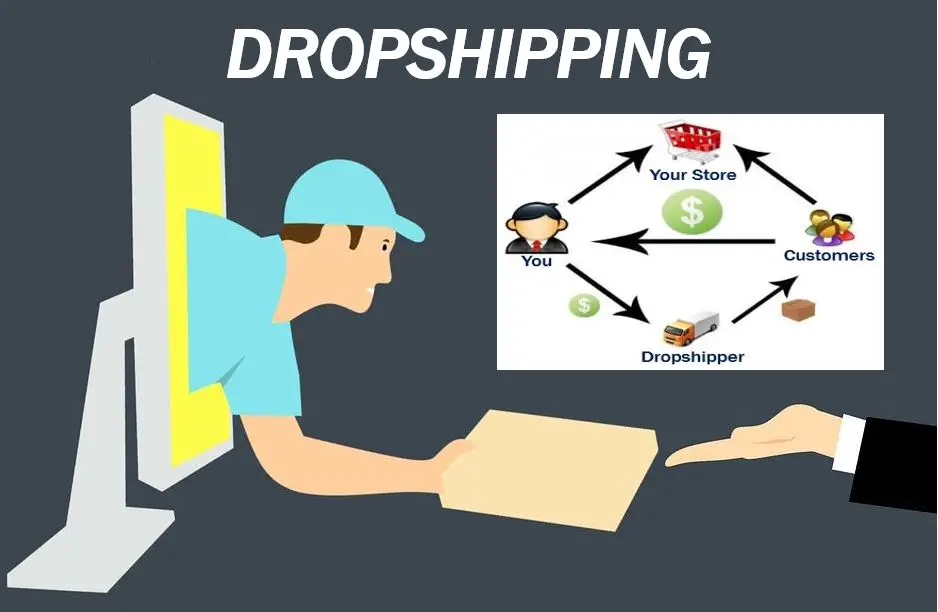

1. Dropshipping

Dropshipping businesses generate income by marketing and selling products for wholesale customers on behalf of themselves. Business owners rely on an online storefront, an ecommerce platform, and online advertising as tools for generating sales. Business owners who dropship products often can increase sales without increasing inventory levels; some suppliers agree to mark-up products for distribution at a marked up price in return for distribution; this allows business owners to drive additional sales that wouldn’t otherwise exist.

Not all products are suitable for dropshipping; conducting market research may reveal potential opportunities. Little Tail Farms breeds adorable dwarf goats and babydoll sheep for agritourism purposes, while also earning income through print-on-demand merchandise sold through its online store. This additional revenue stream allows Little Tail Farms to provide its visitors with additional fun options during their visit while creating lasting mementos of their stay.

2. Online Courses

Financial independence through passive income is a common goal many share, enabling them to spend more time with family, travel or pursue hobbies without worrying about money issues. Furthermore, having multiple sources of passive income may provide security against economic downturns while securing future generations.

Passive income refers to money you generate through investments without actively engaging with, such as rental properties or dividend stocks. While passive income tends to be more profitable than active income, its establishment often takes some initial time and resources.

Passive income sources range from writing an ebook or creating online courses, to investing in medical protection or risk management strategies that enable you to afford unexpected expenses without compromising your savings or reaching financial goals. Diversifying income streams and keeping abreast of market trends are essential in order to maximize profits. It is wise to diversify and diversify income streams as much as possible in order to optimize returns, as well as keeping informed of market trends so you can maximize profits. Investing in medical protection plans or risk management solutions will allow you to maintain savings while meeting financial goals without risking your health or finances.

3. Selling Print-On-Demand Products

Teespring, Redbubble and CafePress all offer print-on-demand sites where you can generate passive income by selling products featuring your designs to buyers. No printing or shipping are involved so this method provides an efficient means of earning passive income.

Podcasting is another popular passive income business option that requires some initial work; the more effort and investment in your content, the higher your odds are of finding success. Use a simple microphone to record podcast episodes about topics that interest you before marketing it through services like Apple Podcasts and Google Play.

Rental property investing is another effective way to generate passive income, but can involve significant upkeep and maintenance requirements. Before investing, be sure to consult with a certified financial planner about your goals and risk tolerance in this area.

4. Affiliate Sales

One of the more lucrative passive income ideas is becoming an affiliate marketer. This involves placing links on your website leading to third-party products or services and earning commission when someone clicks through and makes a purchase. When choosing products or services to link, make sure they attract enough traffic in order for you to make any real money with affiliate marketing.

Another effective passive income source is by selling spreadsheet and Google Sheet templates online for sale. This option requires minimal time investment and can yield steady revenue streams.

If you possess artistic abilities such as photography or music, consider licensing your work to websites that pay royalties each time the images or songs are used.

5. Video Marketing

Video marketing has become an effective way for businesses to promote themselves and generate money with minimal ongoing effort. But for it to work effectively, videos must tell an engaging story while aligning with the goals of your marketing funnel – such as increasing website traffic or driving sales leads through an effective call-to-action. For maximum effectiveness, short, entertaining videos with clear call-to-action should also feature.

Zight makes creating high-quality videos easy. Plus, integrating it with HubSpot, Marketo and Pardot tools makes for seamless marketing campaigns.

Rent out your car on platforms such as Turo and Stow It to drivers for a fee, making a tidy sum without much work involved! Doing something you enjoy while earning extra income could prove fruitful.

6. Buying and Selling Online Stores

Selling digital products is one of the best ways to generate passive income. Though this requires significant upfront work and long-term dedication, its rewards may be substantial.

Investments that pay dividends can also provide a source of steady, passive income; but, to do this effectively, work with your financial advisor in selecting appropriate options.

Establishing multiple streams of passive income can be an invaluable way to reach financial independence and pass along a legacy for future generations. But it’s essential not to spread yourself too thin: focus on developing each passive income source before adding another. Doing this will ensure that, should one stream start faltering, there will always be options to fall back on; plus, the greater diversity your income sources bring, the less dependent you’ll become on one job alone.

7. Starting a YouTube Channel

Make money on YouTube and other social media platforms, like TikTok, by creating engaging, click-worthy content that grabs people’s attention. Many YouTube creators make thousands each month from their channels – and the best part? Starting is free.

Renting out items you no longer use such as a boat, camper or vehicle can be an excellent source of passive income. Services such as Turo provide one solution while car advertising agencies may pay to place ads on your car to drive around town with it and get paid per mile driven around town with it displaying ads.

YouTubers can monetize their content through selling merch, which not only generates revenue but can build and strengthen fan connections to their brand. Before investing in passive income streams such as selling merchandise or selling merch, it is wise to create an emergency fund – consider purchasing high-yield savings accounts or opening retirement accounts so as to have some financial security in the form of emergency savings accounts or retirement plans for retirement savings purposes.

8. Creating Apps or Skills

If you possess the relevant expertise, creating apps and services that generate income without your direct involvement can be done without breaking the bank. But this activity takes time and requires significant initial investments to achieve results.

Uploading designs to print-on-demand websites allows you to generate passive income each time someone purchases one of your designs emblazoned t-shirts, coffee mugs or other products featuring your artwork. Without having to take care of printing or shipping yourself, print-on-demand sites provide an alternative retail model which alleviates many of its hassles and headaches.

Photographers, musicians and artists can generate additional income by licensing their work for commercial uses — such as ads, YouTube videos or movie trailers. Licensing can also serve to promote your art and build your audience.

Another form of passive income comes in the form of investing in dividend stocks, which offer regular payouts with minimal involvement required on your part. Real estate investment may also provide passive income but does require upfront capital costs as well as ongoing maintenance expenses.